Blog Details

How Streamlined Processes Save Your Mid-Market Company Millions

December 10, 2024

Navigating the middle market presents unique challenges and opportunities. Unlike larger corporations, mid-market companies are more vulnerable to economic fluctuations and often struggle with resource constraints and talent retention. Yet, this environment also creates opportunities for dynamic leadership to make a significant impact. With strategic guidance, mid-market companies can not only survive but thrive, outperforming their peers and achieving rapid growth.

Central to overcoming these challenges is robust financial management. In mid-market firms, the CFO’s role is pivotal; effective financial leadership can be the decisive factor in driving efficiency, innovation, and sustainable growth.

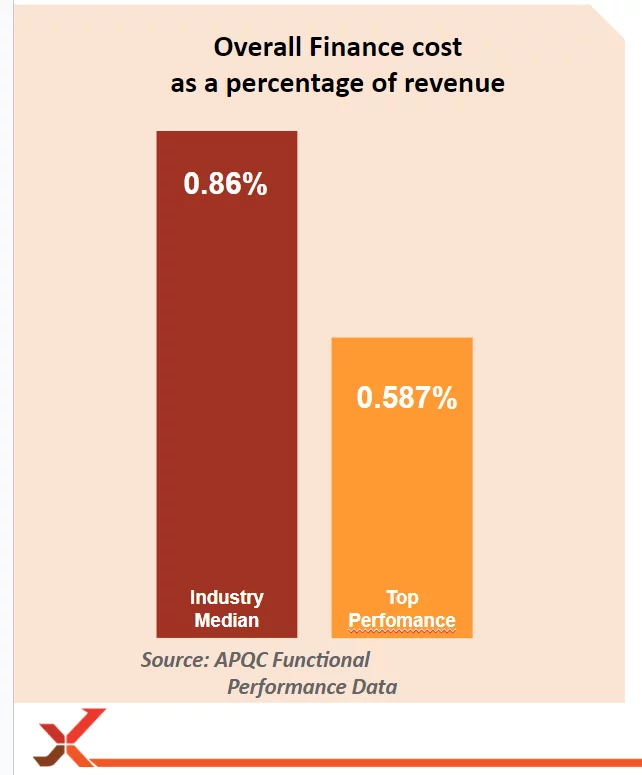

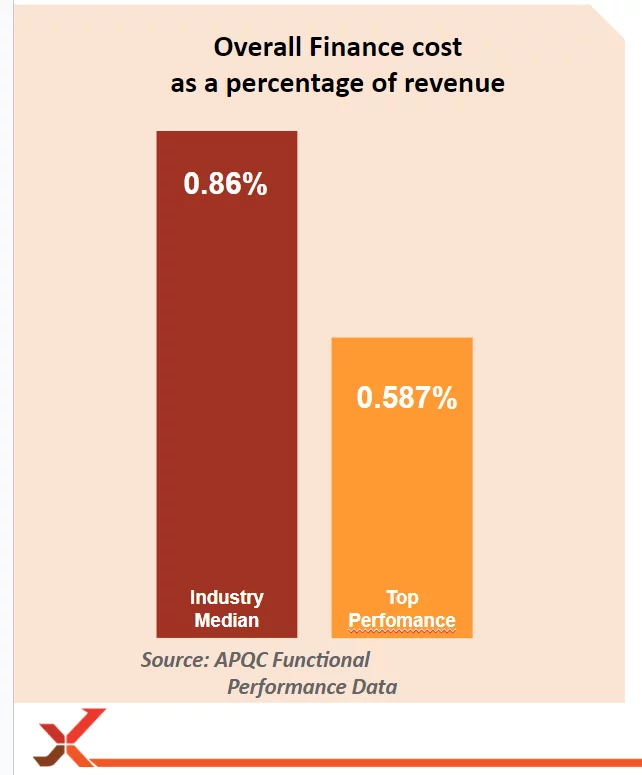

One of the most powerful ways CFOs can impact their organizations is by streamlining and optimizing financial processes. According to APQC Functional Performance Data, top-performing companies with efficient financial operations have 32% lower finance function costs as a percentage of company revenue than the industry median.

This article is the first in our series 6 Pillars of Top Performing Finance Functions. Workable strategies for eliminating inefficiencies in your current systems.

Here’s how this kind of focus can benefit a mid-market company:

Here’s how this kind of focus can benefit a mid-market company:

How Restructuring Financial Processes Can Transform Organizations

The way finance and accounting processes are structured at many companies, especially in the mid-market segment, can lead to significant inefficiencies. Processes often span across multiple, often disparate, systems and departments, with unnecessary steps that slow down key organizational functions. Inefficient financial processes consume valuable resources through an increased error rate, wasted time and inflated operational costs. Here’s how this kind of focus can benefit a mid-market company:

Here’s how this kind of focus can benefit a mid-market company:

- Enhanced efficiency and reduced costs: Streamlining transaction processing (R2R, P2P, O2C) can eliminate redundant tasks and minimize manual effort, leading to lower operational costs and better resource allocation.

- Accelerated cash flow: Financial cycles can be optimized through automation, which can lead to quicker processing times and better cash flow management.

- Improved accuracy and compliance: Automated processes result in reduced errors and enhanced data reliability. This leads to more accurate financial reporting and strengthens your organization’s compliance posture.

- Unlock strategic value: When you shift transactional tasks to self-service models and automate processes, you empower your finance team to focus on higher-value activities such as business partnering, data analysis and decision support. In this way, you can cultivate a finance function that drives strategic growth.

Optimizing Your Organization’s Core Financial Processes

Here are some actionable ways in which CFOs can optimize their R2R, P2P and O2C cycles to save time and resources.1. Record to Report (R2R)

The R2R cycle starts from the moment transactions are recorded and ends with the creation of financial reports that detail the performance of the organization. The R2R cycle includes the collection and processing (including coding to the appropriate accounts) of any financial transaction across the organization. Inefficiencies in the cycle can lead to delayed reporting, loss of stakeholder trust and revenue leakage. While median performers employ an average of 23.3 FTEs in R2R per $1 billion in revenue, top-performing finance functions have managed to optimize processes enough to only need 5.7 FTEs per $1 billion. Here’s how CFOs can take example and optimize R2R cycles at their organizations.Rationalize Journal Entries

Rationalizing journal entries involves realigning, eliminating or reducing low-materiality entries. By focusing on significant transactions, companies can simplify their accounting processes, minimize complexity and decrease the likelihood of errors.Automate Journal Entries

Automating journal entries through integration and robotic process automation (RPA) tools transforms tedious manual tasks into an efficient automated process. By leveraging technology, companies can automatically create and post journal entries without any human intervention. Since automated systems can ingest data at much faster speeds, this also ensures that financial data is updated in real time.Utilize Purpose-Built Tools for Reconciliation

Specialized account reconciliation software can automate reconciliation processes, identifying discrepancies quickly and providing a clear audit trail. By automating reconciliations, companies can reduce the time spent on closing books and ensure that financial statements are reliable and accurate.Implement Soft Close Concepts

Introducing soft close concepts allows for continuous financial reporting and periodic reviews without a full hard close each month. This means updating financial data regularly and performing key reconciliations throughout the period. This approach enables management to access timely financial information for decision-making and reduces the workload at period-end.Establish R2R Continuous Improvement Monitoring

Setting up systems to regularly review and improve R2R processes ensures they remain efficient and effective. Finance departments should create and track KPIs and solicit feedback from stakeholders to gauge process effectiveness. By regularly assessing the R2R process, companies can identify bottlenecks and eliminate redundancies.Reduce Chart of Accounts (COA) Complexity

Simplifying the COA reduces errors and makes financial reporting more straightforward. By consolidating accounts and removing obsolete or redundant entries, companies can streamline their financial structure. A single streamlined COA enhances clarity and improves data consistency. It can also make it easier to integrate financial systems during mergers or acquisitions.2. Procure to Pay (P2P)

The P2P cycle encompasses the whole procurement process, from requisition to payment. Inefficiencies in this process can lead to problems such as delayed payments, damaged supplier relationships and missed discount opportunities. Top performers only need 6 FTEs for their P2P cycles per $1 billion in revenue. Median performers employ twice that — 12 FTEs per $1 billion. Here are some concrete steps CFOs can take to optimize their P2P cycles.Establish a Vendor Portal

Creating an online vendor portal improves transparency and efficiency in supplier interactions. A vendor portal allows suppliers to manage invoices, payments and communications in one place. By providing real-time access to payment status and purchase orders, companies reduce email and phone call inquiries and improve collaboration with vendors.Expand OCR/ICR and RPA Technologies

Optical character recognition, intelligent character recognition and robotic process automation can all be used to streamline invoice data capture. By extracting information from paper or scanned documents systematically, companies reduce manual data entry errors and accelerate invoice processing times. Automation technologies ensure that invoice data is accurately captured and integrated into the accounting system. Faster data processing leads to faster approvals and payments.Adopt Workflow Automation

Workflow automation software can streamline approvals and other P2P processes. Automated workflows route purchase orders and invoices to the appropriate personnel for approval based on predefined rules. This can reduce manual tasks, speed up cycle times and ensure that processes are operating in compliance with company policies. Workflow automation software can also give employees the ability to track the status of requests. At the same time, management can gain valuable visibility into the entire procurement process.Implement Evaluated Receipt Settlement (ERS) and Two-Way Matching

Evaluated receipt settlement and two-way matching simplifies the payment process. ERS allows companies to pay suppliers based on the receipt of goods without requiring an invoice. Two-way matching verifies that the purchase order and goods receipt align, eliminating the need for invoice verification. This reduces paperwork, prevents overpayments and streamlines the payment cycle.Vendor Rationalization

Streamlining the number of vendors simplifies management and can lead to cost savings. By consolidating suppliers and focusing on strategic partnerships, companies can negotiate better terms and volume discounts. Vendor rationalization reduces administrative overhead, as there are fewer relationships to manage and fewer invoices to process.Adopt a Procurement Card (P-Card) Program

Introducing procurement cards (P-Cards) simplifies the purchasing process for low-value items. P-Cards allow authorized employees to make small purchases directly, reducing the need for purchase orders and invoices. This can both decrease processing costs and speed up procurement for small purchases. Procurement cards also provide detailed transaction data, which helps enable better tracking and control over expenses.Establish P2P Continuous Improvement Monitoring

As always, regularly assessing and enhancing P2P processes ensures they remain efficient. Analyze performance metrics, collect feedback from users and suppliers and try to stay abreast of technological advancements.3. Order to Cash (O2C)

The Order-to-Cash cycle encompasses activities like customer order requests, order completion and receipt, as well as invoicing and the collection of payments from customers. Enhancing the O2C process improves cash flow and customer satisfaction. By automating key functions and providing better customer experiences, mid-market companies can accelerate revenue collection and strengthen customer relationships. Median performers deploy 15.3 FTEs per $1 billion in revenue in their O2C cycles. Top performers have cut that number by over 60%, only needing 5.9 FTEs per $1 billion. Here’s how organizations can implement leading processes to optimize their O2C cycle.Focus on Customer Self Service

Creating a customer portal with electronic invoice presentation and payment (EIPP) capabilities allows customers to manage their accounts online. Customers can view invoices, make payments electronically and access account history at their convenience. This self-service approach can improve customer satisfaction, while at the same time reducing the time spent on inquiries.Utilize Automated Document Management

Automated document management systems can organize customer documentation efficiently. Automation ensures that contracts, orders and correspondence are stored securely and are easily retrievable. This improves internal efficiency and enhances customer service, as representatives can access necessary documents quickly when addressing customer needs.Streamline O2C With Workflow Automation

Using automated workflows in the O2C process streamlines order processing, billing and collections. Automation routines can route orders for fulfillment, generate invoices promptly, proactively remind customers of upcoming invoice due dates and schedule follow-ups for overdue payments. By reducing manual intervention, companies can accelerate processing times and improve the consistency of customer interactions.Create a 360-degree View of the Customer Journey

Developing comprehensive customer profiles allows organizations to capture all customer interactions and transactions in one place. By integrating data from sales, customer service, marketing and finance, companies can gain a holistic view of each customer. This enables enhanced focus on personalized service and targeted marketing.Establish Customer Channel Strategies for Upfront Payments

Creating payment strategies that encourage or require upfront payments improves cash flow. Companies can offer incentives for early payment, require deposits or implement payment upon order for certain products or services. By securing payments earlier in the cycle, companies reduce the Days Sales Outstanding (DSO) metric and enhance liquidity.Establish O2C Continuous Improvement Monitoring

Continuously evaluating and refining O2C processes optimizes cash flow and customer satisfaction. Track key metrics such as DSO, order accuracy and customer satisfaction scores, and adjust processes as necessary.Identifying and Eliminating Inefficiencies

To successfully transform an organization’s financial processes, CFOs must first identify the most significant inefficiencies. Once a proper analysis has been done, CFOs and their departments can then take actionable, measured steps towards optimization. Here is a step-by-step guide for identifying inefficiencies in financial processes:- Undertake a Process Audit: First, audit your current finance and accounting procesess for bottlenecks, redundancies and areas where errors are common. Make workflows real and bring them to life with process mapping to identify inefficiencies.

- Benchmark Against Industry Standards: Compare performance metrics with industry standards to identify existing gaps and set realistic improvement targets.

- Leverage Technology: Invest in technological solutions that address the organization’s specific needs. This could include enterprise resource planning (ERP) systems, automation tools and data analytics platforms. Solutions should have automated operations, create data accuracy and provide data-driven information for decision-making.

- Train and Empower Employees: Train employees on how to operate with new systems and processes. It can be helpful to highlight the benefits the changes will bring, both to them individually, as well as to the company. When team members understand why changes are made and see the benefits themselves, they tend to be less resistant to adopting them. Try to encourage a continuous improvement culture — employees should feel free to recommend improvements and be empowered to implement them.

- Monitor and Review Regularly: Define key performance indicators (KPI’s) to measure the effectiveness of your new finance processes. Constantly track metrics and adjust your strategy when opportunities for improvement present themselves.

The Power and Benefits of Value-Added Finance Services

“Top CFOs are pivoting to value-added services supported by leading practice processes.” Top-performing CFOs are redefining the role of finance in their organization. This is a movement the ACAA calls “value management” and is currently spreading to all parts of C-suite leadership. By embracing leading-edge technologies, people and processes, leadership is shifting focus from time-consuming, manual tasks to strategic, value-added services that directly impact the bottom line. To emulate these high-performing finance functions, consider these strategies:- Embrace Integrated Business Planning (IBP):p Align your financial planning with overall business objectives for a holistic view of the organization.

- Adopt a Rolling Forecast Mindset:Continuously update your forecasts to reflect changing market conditions and business performance.

- Prioritize Strategic Gap Closure: Focus on closing the gap between your current performance and strategic goals, rather than dwelling too much on past variances.

- Leverage Self-Service Analytics:Empower your organization with standardized, automated reporting and key performance indicators (KPIs) dashboards aligned with strategic objectives.

My Final Advice To Mid-Market CEOs and CFOs on Finance Process

Finance is not a department that should operate independently — enhancing your finance and accounting processes should not be just another way to cut costs. It should be a strategic company-wide initiative that drives multiple financial and operational benefits, cohesively tying finance to critical decision-making. If anything in this article piqued your interest as something you would like to implement at your organization but you aren’t sure where to start, or maybe it only highlighted something you already know is a challenge in your organization, let’s have a conversation about it. I help clients every day outline plans to tackle these areas and would love to be of assistance to you as well. You can complete this form and just indicate “I would like to talk with Brock about his article on streamlining processes”.Latest Insights

Related Blogs

Contact Us